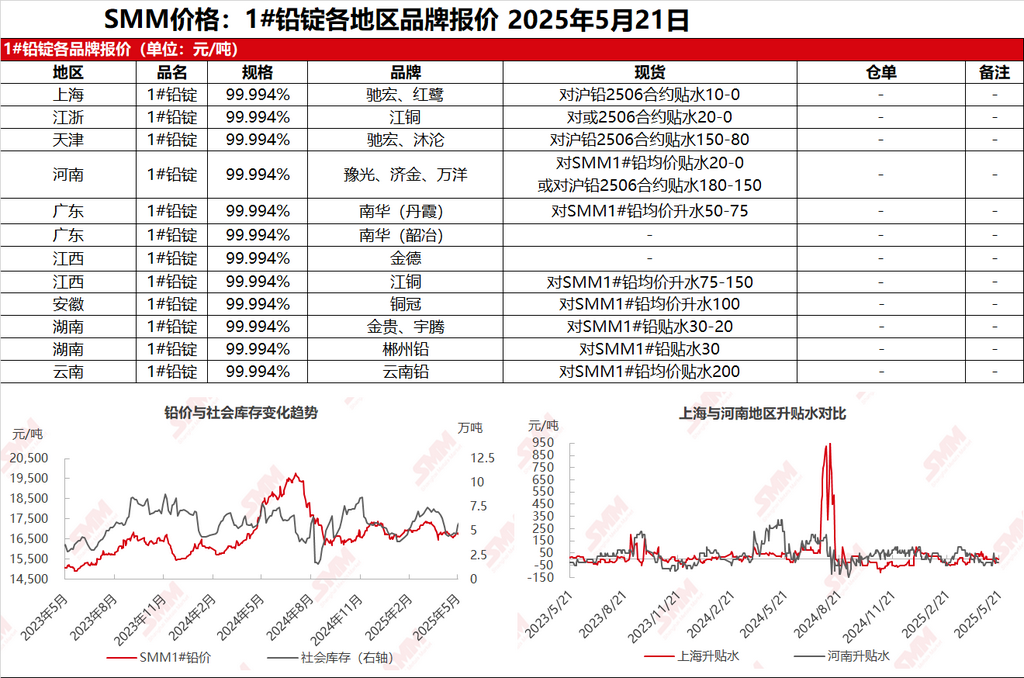

SMM News on May 21: In the Shanghai market, Chihong and Honglu lead were quoted at 16,865-16,905 yuan/mt, with quotations against the SHFE lead 2506 contract at discounts of 10-0 yuan/mt. In the Jiangsu-Zhejiang region, JCC lead was quoted at 16,855-16,905 yuan/mt, with quotations against the 2506 contract at discounts of 20-0 yuan/mt. SHFE lead maintained a consolidation trend, and suppliers quoted prices accordingly. During this period, the ex-factory quotations for cargoes self-picked up from primary lead smelters in major producing areas were at discounts of 30 yuan/mt to premiums of 100 yuan/mt against the SMM 1# lead average price. In the secondary lead sector, smelters showed poor enthusiasm for shipping, with some halting shipments. The ex-factory quotations for secondary refined lead were at discounts of 50-0 yuan/mt against the SMM 1# lead average price, with a few regions quoting at premiums. The purchase willingness of downstream enterprises was moderate, and spot order market transactions turned weak again.

Other markets: Today, the SMM 1# lead price increased by 75 yuan/mt compared to the previous trading day. In Henan, suppliers quoted prices at discounts of 25-0 yuan/mt against the SMM 1# lead price, or at discounts of 180-150 yuan/mt against the SHFE lead 2506 contract for ex-factory cargoes self-picked up from production sites. In Hunan, smelters quoted prices at discounts of 30 yuan/mt against the SMM 1# lead average price. Some smelters mentioned factors such as raw material costs, showing reluctance to sell at low prices. Traders quoted prices at discounts of 200 yuan/mt against the SHFE lead 2506 contract. In Anhui and Jiangxi, smelters maintained ex-factory quotations at premiums of 100-150 yuan/mt against the SMM 1# lead average price. In Guangdong, suppliers' ex-factory cargoes self-picked up from production sites were traded at premiums of 50-75 yuan/mt against the SMM 1# lead average price for just-in-time procurement. Today, lead prices rebounded and rose. Downstream enterprises still focused on just-in-time procurement. Coupled with the reduced shipments from secondary lead smelters, regional transactions in the spot market were moderate.